March was a record month for fundraising by US airlines. Sparked into action by the coronavirus crisis and less than comfortable liquidity levels, the US airlines actively worked their unencumbered assets and their banking relationships to raise a total of $12.4 billion.

Most of the airline group moved to draw their undrawn commitments, presumably taking greater comfort from cash in their bank accounts than a commitment letter in the vault. One can be fairly sure also, that the airlines will have moved their temporary excess of cash to banks with whom they do not have borrowing relationships, for avoidance of “set-off” risk.

With the exception of the $1 billion secured equipment notes issued by Delta Air Lines, the other facilities are all “Covid-19 bridges” with a one-year tenor or, in Spirit’s case, two years. This would seem to show a degree of optimism that the global economy and travel industry will be functioning with some semblance of normalcy by the first quarter of 2021 – though presumably at lower levels than 2020.

Assets deployed in support of these financings covered the entire spectrum – aircraft (young and old), slots, gates, route authorities, spare engines, spare parts, ground equipment, flight simulators, real property and executives’ future bonuses (joking).

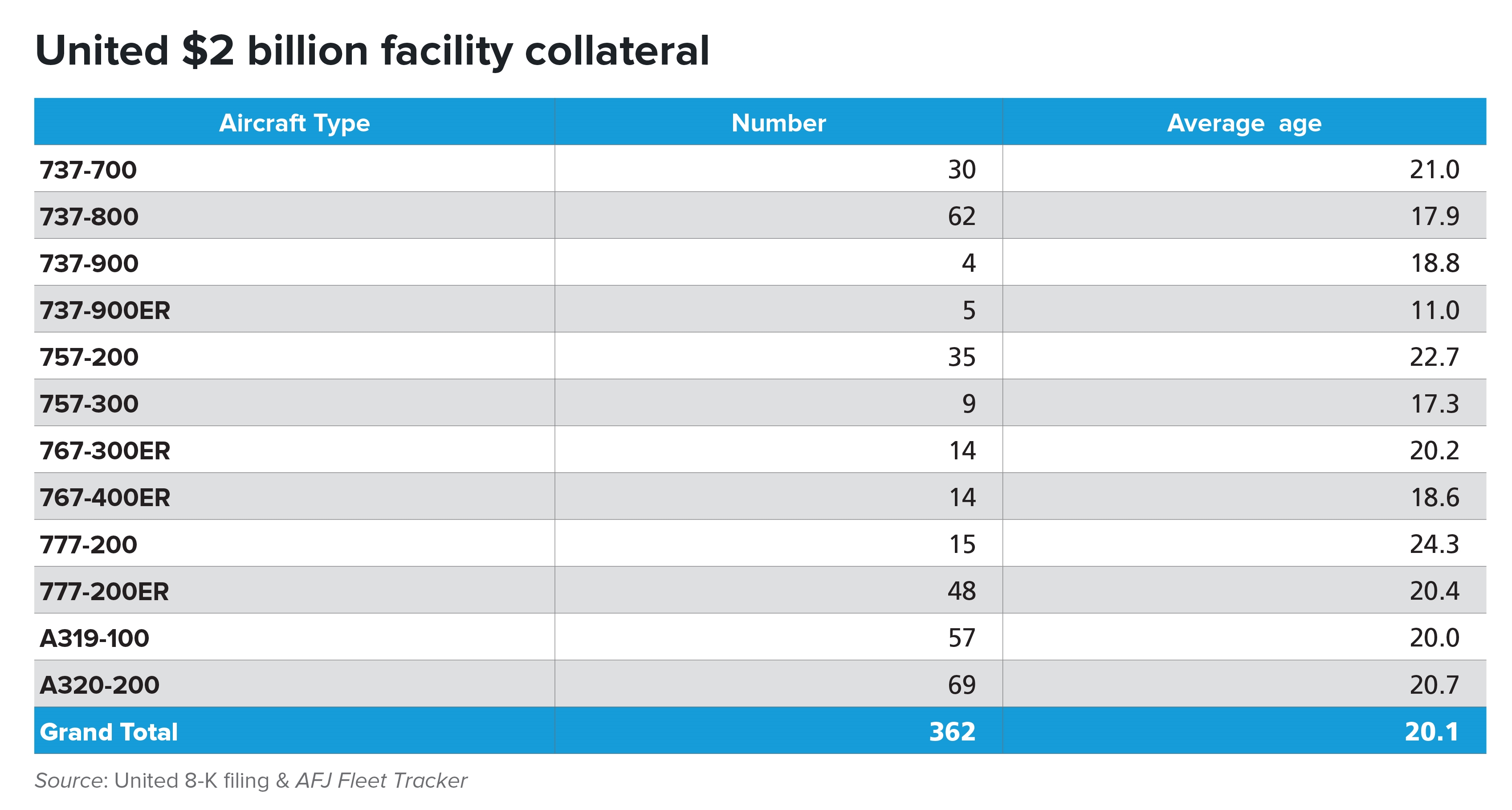

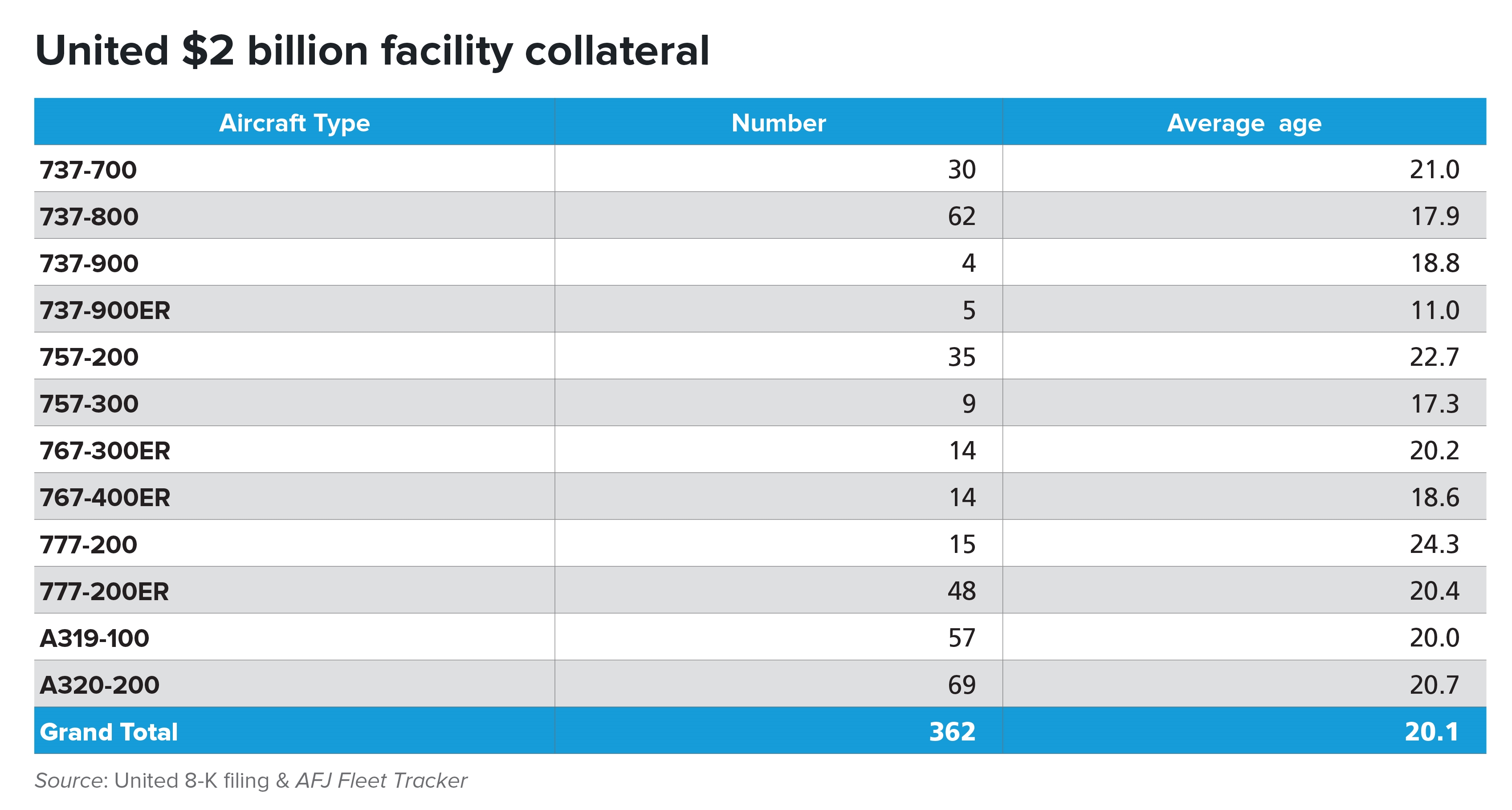

There were some unique financings in the mix. Airfinance Journal’s favourite is United’s $2 billion 364-day term loan secured by 362, repeat 362 aircraft. Just two more and it would have been one-per-day of the loan. We think this must be a world record for the most aircraft involved in a single facility. Closer examination reveals the reasons – the collateral package involves mostly mature aircraft and some less than liquid types and had an average age in excess of 20 years. By Airfinance Journal’s calculations the LTV was approximately 41% based on pre-Corona values, which is reflective of current market conditions and the quality of the collateral.

Other notable facilities are American’s “delayed draw” term loan that was fully drawn a week later and Delta’s $2.6 billion secured term loan of which $2.3 billion was drawn before the end of the month. Airfinance Journal understands the collateral pool includes younger and core fleet and that the LTV was close to 70%. Delta also drew $3 billion under its existing revolving credit facility. Jetblue’s facility was secured by a young (average age 3.9 years) portfolio of seven A320neo and 17 A321 aircraft, which must have helped achieve the attractive pricing of LIBOR plus 1.75%.

Among the smaller carriers, Jetblue raised and drew its $1 billion term loan secured by aircraft and spare engines.

Alaska Air Group arranged two facilities, $425 million secured by aircraft and $388 million secured by aircraft and a broad selection of other asset types. Spirit came late to the refuelling party with a new $110 million revolving credit (with an accordion feature that can increase the facility to $350 million subject to approval of the new lenders) which Airfinance Journal believes is presently undrawn. Advice to Alaska and Spirit: take a leaf out of your bigger brothers’ books and draw those facilities fast!

The pricing range was wide, reflecting the differences in credit quality and collateral. Pricing (all expressed as a spread over LIBOR) ranged from a low of 1.00% for Southwest to a high of 2.75%-3.5% for the United spare parts facility. Spirit achieved a very creditable 2.00% supported by its varied collection of collateral.

Analysis of the 8-Ks and press releases reveals that JP Morgan, Citi, Morgan Stanley, Bank of America and Goldman Sachs were the most active arrangers.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Phasellus ultrices urna eu consequat pulvinar. Suspendisse malesuada scelerisque iaculis. Cras ut facilisis arcu, posuere efficitur nisi. Fusce dictum tortor ac nibh rhoncus auctor. Praesent nunc felis, elementum vel orci quis, sodales tincidunt nisi. Vestibulum vestibulum vel erat quis feugiat. Nam nec pulvinar velit. Nunc feugiat felis lacus, non condimentum urna interdum vitae. In laoreet hendrerit commodo. Sed diam arcu, tincidunt quis augue ac, venenatis consequat dui. Quisque maximus venenatis erat, sed malesuada quam malesuada at. Aenean non quam a ex vulputate laoreet. Praesent eget neque convallis, rhoncus lorem a, venenatis metus. Maecenas sed malesuada purus.

Integer vel neque vel odio tempor laoreet. Praesent vel malesuada dolor, sit amet aliquam augue. Cras magna tortor, ullamcorper nec tristique ac, accumsan quis metus. Integer in magna sit amet leo vulputate vulputate. In pretium quam libero. Cras a pulvinar arcu, et rutrum orci. Proin euismod, justo quis scelerisque porttitor, purus odio dignissim ex, eu rhoncus lorem dolor sit amet mi. Pellentesque in massa vel mauris tempus euismod. Aenean efficitur vestibulum arcu ut elementum. Nam rhoncus ligula vel enim iaculis, quis luctus dui interdum. Nulla erat mi, lacinia eu orci ut, hendrerit fermentum lorem. Sed non gravida quam. Pellentesque habitant morbi tristique senectus et netus et malesuada fames ac turpis egestas. Nulla bibendum erat odio, pharetra lobortis eros blandit a.

In et ultrices ante. Vestibulum consequat libero quis quam tempor, efficitur accumsan lacus sollicitudin. Class aptent taciti sociosqu ad litora torquent per conubia nostra, per inceptos himenaeos. Phasellus ac est lacus. Quisque in interdum urna, non pulvinar sem. Duis tristique tortor vel urna commodo tincidunt sit amet ut sem. In sapien turpis, porta vitae neque in, varius egestas erat.

Interdum et malesuada fames ac ante ipsum primis in faucibus. Donec quis est vel ante facilisis efficitur. Pellentesque tincidunt odio eget lacinia vestibulum. Aliquam erat volutpat. Ut ac ipsum non nisi convallis eleifend et ornare lectus. Pellentesque diam nulla, dapibus quis convallis sed, posuere at urna. Proin tincidunt tincidunt nibh, id molestie est. Integer iaculis, leo sit amet pulvinar pellentesque, tellus elit vehicula ipsum, eget vulputate dui tortor vitae sem. Proin rhoncus venenatis tellus, vitae blandit ipsum malesuada sed. Morbi gravida magna hendrerit faucibus imperdiet. Ut bibendum a massa at efficitur. Donec egestas urna urna, sit amet mattis erat fringilla sit amet. Integer scelerisque enim sed odio semper molestie. Sed tincidunt malesuada nulla a fringilla. Nullam suscipit, justo nec facilisis efficitur, arcu mauris finibus lorem, ut egestas mi purus nec neque. Nunc nec euismod est, ac egestas neque.

Vivamus sit amet pretium quam, vitae fringilla dolor. In nec ligula arcu. Fusce a tortor leo. Sed blandit leo quis turpis sodales, eget tincidunt tortor ultrices. Fusce scelerisque eros quis quam vestibulum tempus. Praesent sodales aliquam nibh vel fermentum. Quisque vel diam sit amet sem convallis interdum. Proin ac velit molestie, malesuada tellus vitae, tempus est. Sed facilisis ut enim ac pretium. Mauris scelerisque fermentum risus, nec ultricies enim finibus vel. Aenean sem enim, dictum mollis aliquet nec, consequat nec nisl. Duis aliquam a lectus vitae ornare.