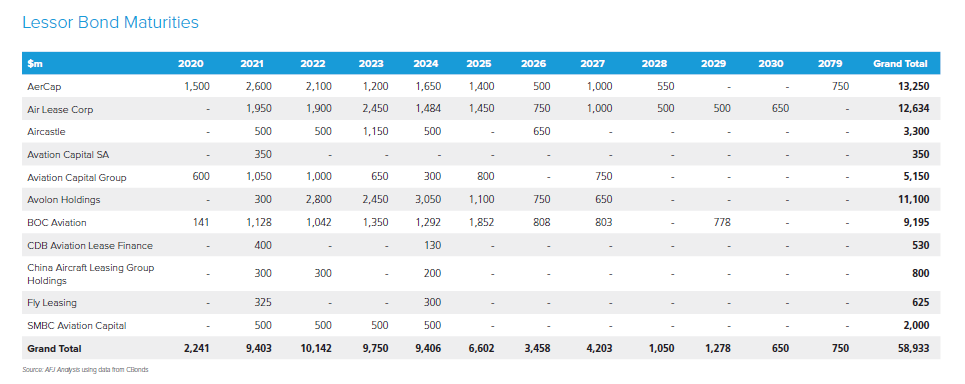

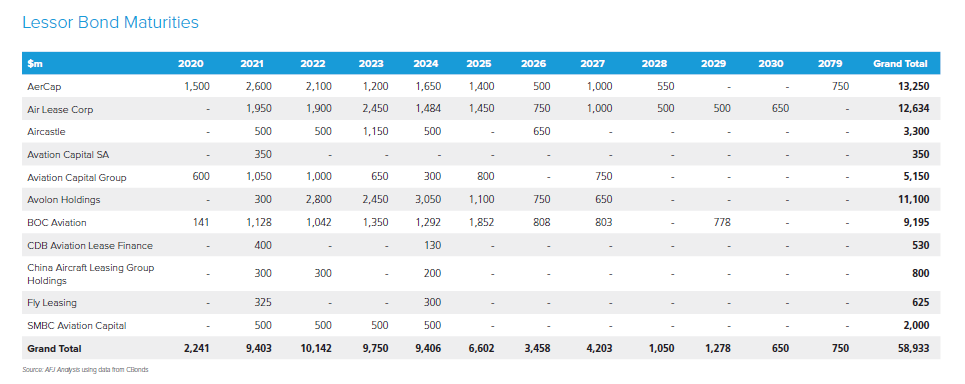

Eleven aircraft leasing companies surveyed by Airfinance Journal have a combined $59 billion in bond maturities through 2030.

US lessors have the most bonds to repay, followed by their counterparts in Europe and Asia-Pacific, although large differences exist.

Irish platform Aercap leads the pack with $13.3 billion in outstanding bonds, followed by US lessor Air Lease (ALC) with $12.6 billion, Avolon with $11.1 billion, BOC Aviation with $9.2 billion, Aviation Capital Group (ACG) with $5.2 billion and Aircastle with $3.3 billion.

In 2020, Aercap has $1.5 billion of bonds coming due, split between $500 million at an interest rate of 4.25% on 1 July and $1 billion at 4.625% due on 30 October.

Also in 2020, ACG needs to repay $600 million with a 7.125% coupon by 15 October; while BOC Aviation has RMB1 billion ($141 million) at 4.5% to be settled by 17 October.

The following year, in 2021, the numbers become much bigger. Aercap has $2.6 billion due, ALC has $1.95 billion, BOC Aviation has $1.13 billion and ACG has $1.05 billion. Singapore-based regional lessor Avation has $350 million due on 15 May 2021.

Repayments will be even higher in 2022 and 2023, ringing in at a combined $10.1 billion and $9.8 billion respectively.

Until now, an extremely attractive long-term financing environment of low rates offered by the bond market helped fuel the unprecedented growth of aircraft leasing companies observed particularly over the past decade, providing an indispensable source of cheap capital to the industry’s major players. But what will the future hold?

Airfinance Journal analysis shows that the $58 billion in total outstanding bonds have a weighted average coupon rate of just over 4.2% but those days appear to be over as Covid-19 continues to wreak havoc in the aviation industry with now at least $314 billion in airline revenue losses predicted by IATA in 2020 only. And even that number is likely to increase as devastating second and third quarter results will start coming in.

As a result, yields on lessor bonds continue to blow out as investors balk at the growing prospect of unprecedented airline collapses and OEM supply chain bankruptcies leading to a glut of aircraft coming onto the market. The widebody market in particular could shrink to just 20% of its forecast output numbers over the next three years, or longer, analysts say.

Data shows that yields on 2024/25 public bond maturities have reached 8-10%. If such debt cost becomes reality for future issuance, lease yield factors would need to increase by 0.33-0.50% per month to preserve lessor spreads and return on equity.

This raises questions about what the future bond market might look like and whether the bond and bank markets would shy away from aircraft transactions. If so, will the lessors have enough existing cash to meet all maturities?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Phasellus ultrices urna eu consequat pulvinar. Suspendisse malesuada scelerisque iaculis. Cras ut facilisis arcu, posuere efficitur nisi. Fusce dictum tortor ac nibh rhoncus auctor. Praesent nunc felis, elementum vel orci quis, sodales tincidunt nisi. Vestibulum vestibulum vel erat quis feugiat. Nam nec pulvinar velit. Nunc feugiat felis lacus, non condimentum urna interdum vitae. In laoreet hendrerit commodo. Sed diam arcu, tincidunt quis augue ac, venenatis consequat dui. Quisque maximus venenatis erat, sed malesuada quam malesuada at. Aenean non quam a ex vulputate laoreet. Praesent eget neque convallis, rhoncus lorem a, venenatis metus. Maecenas sed malesuada purus.

Integer vel neque vel odio tempor laoreet. Praesent vel malesuada dolor, sit amet aliquam augue. Cras magna tortor, ullamcorper nec tristique ac, accumsan quis metus. Integer in magna sit amet leo vulputate vulputate. In pretium quam libero. Cras a pulvinar arcu, et rutrum orci. Proin euismod, justo quis scelerisque porttitor, purus odio dignissim ex, eu rhoncus lorem dolor sit amet mi. Pellentesque in massa vel mauris tempus euismod. Aenean efficitur vestibulum arcu ut elementum. Nam rhoncus ligula vel enim iaculis, quis luctus dui interdum. Nulla erat mi, lacinia eu orci ut, hendrerit fermentum lorem. Sed non gravida quam. Pellentesque habitant morbi tristique senectus et netus et malesuada fames ac turpis egestas. Nulla bibendum erat odio, pharetra lobortis eros blandit a.

In et ultrices ante. Vestibulum consequat libero quis quam tempor, efficitur accumsan lacus sollicitudin. Class aptent taciti sociosqu ad litora torquent per conubia nostra, per inceptos himenaeos. Phasellus ac est lacus. Quisque in interdum urna, non pulvinar sem. Duis tristique tortor vel urna commodo tincidunt sit amet ut sem. In sapien turpis, porta vitae neque in, varius egestas erat.

Interdum et malesuada fames ac ante ipsum primis in faucibus. Donec quis est vel ante facilisis efficitur. Pellentesque tincidunt odio eget lacinia vestibulum. Aliquam erat volutpat. Ut ac ipsum non nisi convallis eleifend et ornare lectus. Pellentesque diam nulla, dapibus quis convallis sed, posuere at urna. Proin tincidunt tincidunt nibh, id molestie est. Integer iaculis, leo sit amet pulvinar pellentesque, tellus elit vehicula ipsum, eget vulputate dui tortor vitae sem. Proin rhoncus venenatis tellus, vitae blandit ipsum malesuada sed. Morbi gravida magna hendrerit faucibus imperdiet. Ut bibendum a massa at efficitur. Donec egestas urna urna, sit amet mattis erat fringilla sit amet. Integer scelerisque enim sed odio semper molestie. Sed tincidunt malesuada nulla a fringilla. Nullam suscipit, justo nec facilisis efficitur, arcu mauris finibus lorem, ut egestas mi purus nec neque. Nunc nec euismod est, ac egestas neque.

Vivamus sit amet pretium quam, vitae fringilla dolor. In nec ligula arcu. Fusce a tortor leo. Sed blandit leo quis turpis sodales, eget tincidunt tortor ultrices. Fusce scelerisque eros quis quam vestibulum tempus. Praesent sodales aliquam nibh vel fermentum. Quisque vel diam sit amet sem convallis interdum. Proin ac velit molestie, malesuada tellus vitae, tempus est. Sed facilisis ut enim ac pretium. Mauris scelerisque fermentum risus, nec ultricies enim finibus vel. Aenean sem enim, dictum mollis aliquet nec, consequat nec nisl. Duis aliquam a lectus vitae ornare.