Air Investor poll 2024: widebodies

Airfinance Journal’s 2024 investor poll shows that all commercial widebody aircraft types ratings improved in 2023, expect one type the Boeing 767-300ER.

The widebody sector improvement was mainly with a gradual reopening of the Asian economies over the past 18 months to almost full return to capacity worldwide.

The International Air Transport Association (IATA) recently announced that the recovery in air travel continued in December 2023 and total 2023 traffic edged even closer to matching pre-pandemic demand.

According to the organisation, international traffic in 2023 climbed 41.6% versus 2022 and reached 88.6% of 2019 levels. December 2023 international traffic climbed 24.2% over December 2022, reaching 94.7% of the level in December 2019. Fourth quarter traffic was at 94.5% of 2019 levels.

This is further compounded by supply shortages as OEMs remain at lower production and delivery rates still lower than pre-Covid.

In this context, airlines and operators of aircraft spent their time last year to secure capacity for key periods, notably the summer.

This is expected to continue this year and availability of aircraft continues to dry-up.

Widebodies are quickly being snapped up as well as international traffic volumes have rebounded sharply over the past year or so. Aircraft lease rates and values are strengthening, and momentum appears likely to continue given aircraft shortages.

This consensus opinion was echoed in the final quarter of last year when chief executive officer Aengus Kelly said that 90% on average of its widebody assets are extending.

Kelly sees demand for even widebodies accelerating and he noted that most extensions are very long-term. There'll be three to eight years in some cases on the widebodies, they could be even longer on the extensions. Some discussions are double-digit years on the widebodies.

The clear shortage of new aircraft is allowing lease rentals out of production aircraft to at least remain stable and for those in production to exhibit another rise this year.

The shortage of supply continues to drive positive movements for aircraft values and lease rates.

Availability of high quality, twin-aisle lift is rapidly declining and these new technology types are the first to benefit. This is further compounded by supply shortages as OEMs remain at lower production and delivery rates still lower than pre-Covid.

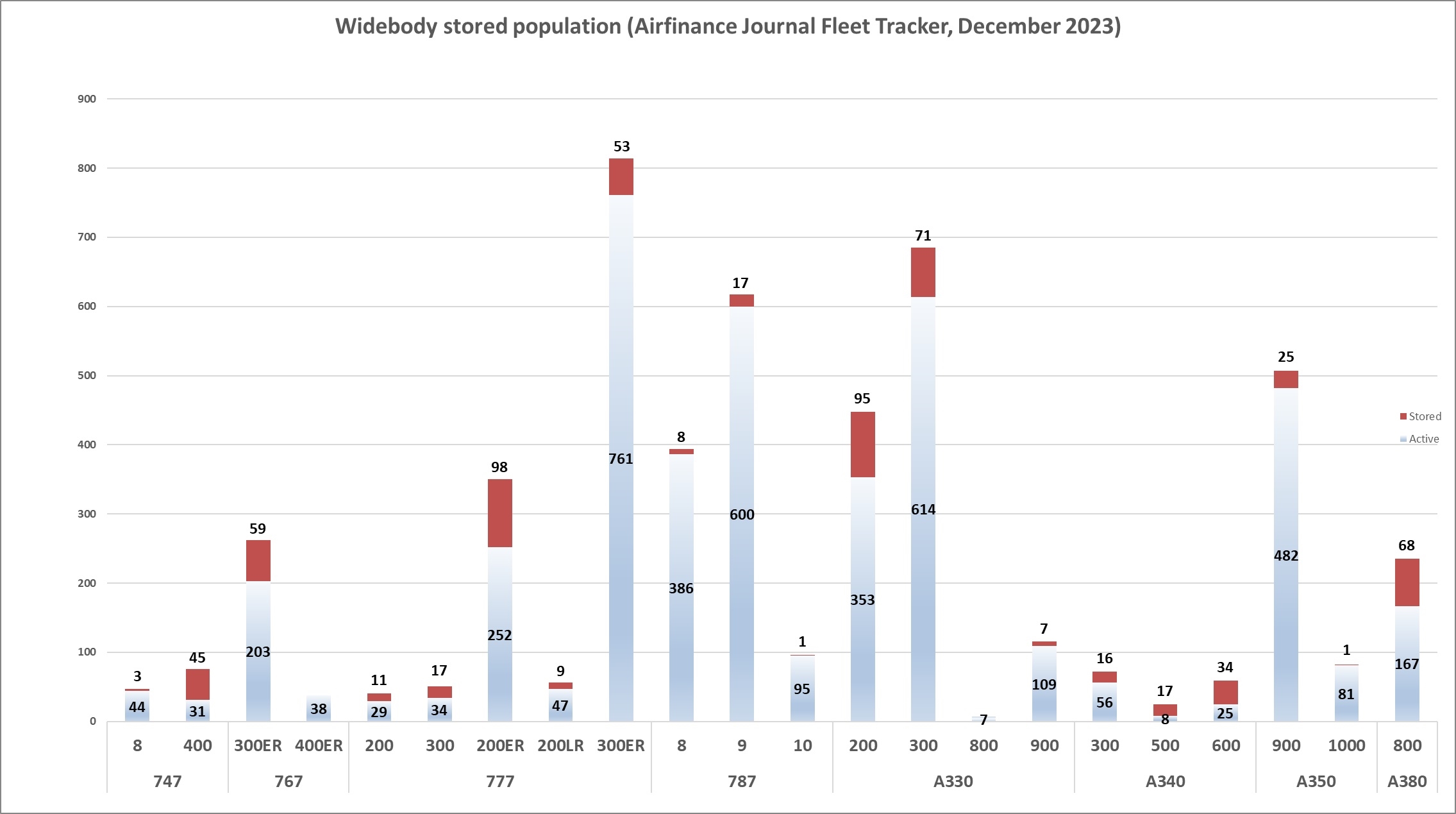

According to Airfinance Journal Fleet Tracker the number of stored or in transition widebody aircraft fell by 25% last year.

The widebody population remained stable at roughly 5,230 units but the stored or in transition population was reduced to less than 700 aircraft, from more than 900 aircraft at the beginning of last year.

The A330 used widebody market represent the major improvement the data shows. Around 60 aircraft have been reintroduced in the system.

The A330-300 market has roughly 690 aircraft in operations and stored. About 10% are stored and in addition 21 units have leases expiring over next 12 months, according to Airfinance Journal’s Deal Tracker data.

Lease rates edging towards pre-covid levels

Lease rates are up significantly for both new placements and lease extensions. Airfinance Journal is aware of relatively young A330-300 extensions in 2022 at $225,000 a month, below industry average.

In comparison a similar vintage was placed last year at $380,000 a month lease rate by an operating lessor for a six-year term.

“The A330 market has turned and now favours the -300 model,” tells an aircraft trader.

According to the trader, A330-300 lease rates are now in the $350,000 range and upwards while the A330-200 monthly rents are above $300,000. “The market favours higher density aircraft,” he adds.

During the Covid period some placements were achieved at low lease rates such as $205,000 a month for mid-life A330-300 aircraft.

At the time the A330-200 market was more buoyant as airlines were looking at capacity with less than 300 passengers. As a result lease rates fetched during that period on aircraft placements were more in the $220-230,000 a month range but lessors were undercutting each others with offers as low as $170-175,000 a month on medium term leases.

“The market for the A330ceo has improved markedly in 2023, with tightening secondary market supply and a slow pace of new technology aircraft deliveries,” comments one pollster.

A leasing source points out that the widebody market to base values was always under the 1% lease rate factor but last year transactions were above that mark.

But an A330 RFP issued in the second half of last year showed the depth of appetite in the widebody market. The RFP included multiple 2010/12-vintage A330s, including A330-300s powered by Rolls-Royce Trent 772B-60s and A330-200s with the Pratt & Whitney PW4160 engine offered for sale “as-is”. Seven of the eight aircraft are unserviceable.

One trader opines that the “naked” aircraft would be difficult to place for the leasing community and requires major investment.

Another source says the aircraft need $10-15 million per engine investment but slot availability with the engine shops, given the current environment, may be difficult to source. “The aircraft will not bring revenues for a period of time,” he comments.

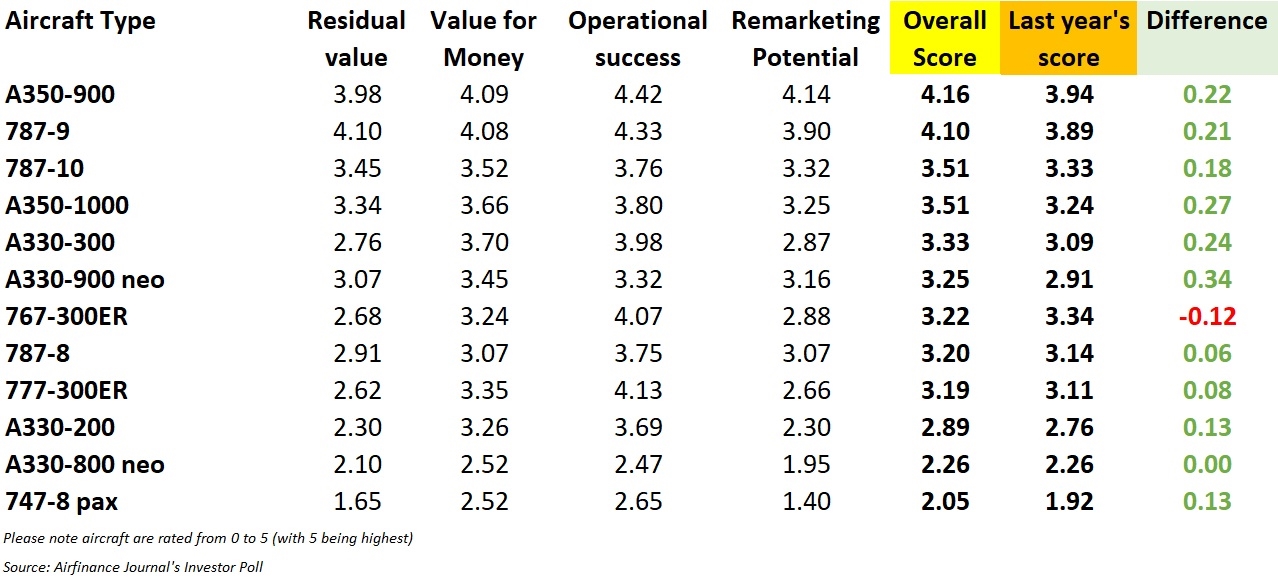

In this year’s Airfinance Journal’s investor poll, the A350-900 topped the rankings, slightly ahead of the Boeing 787-9.

Airfinance Journal Investor Poll 2024 - Widebodies

Both have been the strongest performers in the widebody market for a few years now.

Airfinance Journal understands that a new Airbus A350-900 delivery would lease above $1 million a month now. The market has further strengthened over the past year when lease rates were more in the $925-950,000 range.

One recent transaction included a relatively young A350-900 being traded at $975,000 a month lease rental.

The larger A350-1000 model recorded the second highest improvement in the investor poll. In parallel Airbus recorded a good year 2023 in terms of sales.

“Less demand for this version than the -900 with recent bad publicity received after Sir Tim Clark bashed the Rolls Royce engines for not being as reliable as they should be in the dusty conditions of Dubai. Possible two engine option for the aircraft could have been a solution worth exploring at the time of development,” opines one source.

The market for the A330-900 will be in the $800-850,000 range, sources tell Airfinance Journal, but while the aircraft is getting more acceptance, few data points are available.

Still the A330-900 climbed three places in the investor poll rankings.

The type is becoming more popular as time passes, says a pollster. It current fits both the long haul and short connections with bid demand spaces with the current upgrades that Airbus has made to the aircraft. Another pollster says the A330-900 us a “low-cost alternative” to the 787-8.

The widebody used market has also rebounded for the 787s with lease rates believed to be in the $500-600,000 a month rate. One source mentioned a $560,000 lease rental for a 11-year old aircraft.

At the end of the Covid period lease rates would have been in the $450-500,000 a month range.

The 787 storage population is slightly above the A350 models, as some ex-Norwegian aircraft are slowly being reintroduced into the systems with other airlines.

The 787-9 aircraft has a “great range and capability, perhaps a tad small in size,” comments one pollster.

The smaller 787-8 is described by another pollster as a popular variant for certain sectors of the market where high demand short to medium haul is necessary with a respectable presence in the market as well as good orderbook.

The market for the 767-300ER and 777-300ER products has been more challenging. Trading in those models are still happening in the cargo conversion market and with passenger leases attached for the 777s.

“The market is still with leases attached. Capacity is a problem but naked aircraft that needs lot of investment is a problem,” says one trading source.

Japan Airlines has been seeking proposals for the phase out of its 13 777-300ERs powered by GE90-115B engines. The fleet includes two 2004-vintage aircraft, two aircraft built in 2005, two in 2006, one in 2007, three in 2008 and the remaining three in 2009. Airfinance Journal understands that the carrier withdrew its proposal.

The 777-300ER population included about 50 aircraft in storage at the end of last year. This was down from 82 units 12 months earlier. The model is still a very good prospect for lease extension for lessors with current operators rather than going for remarketing. One source says that the 777-300ER continues to benefit from the 777X delays.

Another source says when international travel fully returns this will be the “best bang for the buck”, and there are passenger to freighter programmes underway.

Overall the 777 population had 190 units in storage or in transit at December 2023, representing 17% of its fleet. This compared with 235 units a year ago, or 22% of its fleet.

The 767 population in storage is mainly for the -300ER but prospects are relatively limited. “It is all about the passenger to freighter market which is driving up passenger value for good candidates,” says a source adding to low passenger feedstock are causing operators to convert to the A330 models.

The improvement in the widebody market is supported by the OEM sales figures in 2023.

Last year Boeing sold 323 widebody aircraft to customers including 84 undisclosed sales, which included seven Boeing 777Fs, four 787-8s, 65 787-9s and 10 787-10s.

Airbus’ gross orders accounted for 342 units in 2023, with the A350 family accounting for 88% of its widebody orders. Its net total was 278 sales and as at 31 December 2023, its backlog for its A330 and A350 families reached 801 units, a 23% increase over 2022.

Market appetite

Asia-Pacific still has not fully recovered from the pandemic and there is “a huge opportunity for continuing recovery” in this region, International Air Transport Association director general Willie Walsh said in February in Singapore.

Asia-Pacific traffic is at about 86% of where the region was in 2019. Domestic markets are performing strongly, but international travel in the region is still lagging at about 73% of 2019 levels. This is predominantly due to the Chinese abstaining from trips abroad due to a tighter economy.

This and many other factors impact investor appetite for aircraft financings in this region, particularly for “big tickets” like widebodies, aircraft investors from Asia-Pacific and the wider financing world tell Airfinance Journal.

Bankers point to an increasing number of opportunities for widebody financing across Asia-Pacific carriers, citing recent landmark aircraft orders from Thai Airways, revived Indian flag carrier Air India, and also Vietjet’s A330neo commitment, which alleviates Airbus’ pain from losing the bulk of the Air Asia group widebody orders during the pandemic.

Investors polled across Asia-Pacific generally agree that those carriers that have traditionally turned to domestic lenders will continue to do so, especially in “difficult” and highly regulated markets like China and Taiwan which “some may not want to touch”.

Carriers from more open Asia-Pacific jurisdictions, however, are expected to continue to look overseas for their aircraft financing requirements, be they finance lease, operating lease or sale and leaseback structures. At the same time, free trade zone jurisdictions like India’s GIFT City International Financial Services Centre will play larger roles going forward.

The Japanese market will remain distinct, sources say. The Japanese yen is still trading poorly against the dollar, prompting the continuation of a post-pandemic trend of Japanese investors acquiring smaller aviation tickets, including used aircraft and engines rather than pricier new-technology aircraft, especially widebodies.

Widebodies, however, remain attractive for Japanese investors if the airline credit attached to it is “safe” beyond reasonable doubt, as witnessed by the continued financing of widebody aircraft in the Jolco space with top credits like British Airways, Air France, Qantas, Cathay Pacific and freight specialists like Cargolux and Atlas Air.

Transatlantic recovery spurs widebody demand

After the immediate collapse of widebody demand during the pandemic, carriers are now struggling to secure widebody capacity as an almost fully recovered transatlantic market brings a recovery in widebody aircraft demand from European and US carriers seeking capacity for the summer 2024 season.

Lufthansa Group reported that its transatlantic traffic is already back at 90% of pre-pandemic levels, whereas Asian routes are still at 74% of their pre-crisis capacity.

Similar numbers were reported by Air France-KLM Group, with Asia traffic recovering strongly but still at 76% of 2019 levels.

International Airlines Group (IAG) also saw a recovery close to pre-Covid levels on its North and South Atlantic routes served by Iberia and British Airways widebodies.

On long-haul routes, Lufthansa also reactivated six previously-out-of-favour A380s from long-term parking in 2023, with another two to be reactivated by 2025, highlighting the extent of the current demand for widebody assets.

This puts lessors and managers of widebody assets in a strong position for 2024 and beyond. As a result, M&A and lessor-to-lessor widebody transactions are expected to increase, with larger volumes of transactions, driven by an uptick in portfolio trading.

One recent example that encapsulates lessor M&A for widebodies is the recent acquisition of Voyager Aviation, and the addition of A330s and 777-300ERs by Azorra.

The latter was a clean-sheet lessor, heading into Covid focusing on crossover jets, but its strategy was always to move into widebodies on an opportunistic basis as the widebody market was the last segment to recover.

The sale and leaseback channel is also expected to increase. However, this will be driven by the pace of new deliveries which OEMs hope to increase in 2024 onwards.

Last year Airbus delivered almost 100 widebodies to customers, compared with 74 aircraft for Boeing. Those included 52 A350-900s along with 12 A350-1000s. It also handed over 29 A330-900s and three A330-800s. Boeing delivered 50 787s and 24 777 freighters, highlighting its dominance in the widebody freighter market over Airbus, which is looking to launch the A350 freighter competitor in the coming years.

The European manufacturer continues to target a ramp-up of production by 2026, with the A350 programme targeted at 10 aircraft per month. The 787 programme production rate was just over six a month but is expected to increase to 10 per month in the 2025/26 timeframe.

In terms of market value, the widebody market has been slower to the recover versus newly built narrowbody aircraft, but market players expect a back-ended recovery this year, particularly for the A330neo and 787-9.

The same is true for used widebodies, particularly larger gauge A330-300s. “Mid-life widebody assets have a strong possibility for an increase in market value,” one source tells Airfinance Journal.

In a scenario where interest rates start to fall this year, the lag in lease rates versus interest rates will benefit widebody aircraft, particularly given the tighter supply and the rate of lease extensions for widebody aircraft experienced by market participants.

Additional reporting by Dominic Lalk and Hugh Davies