Air Investor poll 2024: Regionals

Benefitting from a lack of single-aisle capacity, higher interest rates, and new-technology engine issues for the larger A320 and 737 families, the regional market continues to see improvements in lease rates supported by market activity.

The Embraer 190 is one of the most improved aircraft in Airfinance Journal (AFJ) Air Investor’s regional poll.

It now ranks fifth in terms of residual value, value for money, operational success and remarketing potential, the survey’s four criteria.

The E190 market is further evolving this year with the introduction of a freighter version: the E190F. US leasing entity Regional One has contracted two aircraft for freighter conversion and is expected to receive the first unit in 2024.One aircraft is a 2010-vintage E190 that was operated by Avianca as a passenger aircraft. Regional One purchased the unit in April 2022 from Falko, AFJ’s Fleet Tracker shows. However, no customer has been announced.

Launch customer Nordic Aviation Capital (NAC) has signed a memorandum of understanding to place the first two E190F passenger-to-freighter conversions with Kenya-based Astral Aviation. In May 2022, NAC and Embraer reached an agreement in principle to take up to 10 conversion slots for the E190F/E195F, with deliveries starting in 2024. The aircraft for conversion will come from NAC’s existing E190/E195 feedstock.

In November 2020 AFJ broke the news of Embraer studying the freighter conversion market. The E-Jet freighter conversions fill a gap between the Boeing 737-300 and ATR72 models and are designed to meet the changing demands of e-commerce and modern trade that require fast deliveries and decentralised operations, according to its the Brazilian manufacturer. There has not been any activity in terms of lease rentals but sources tell AFJ that the consensus is around $100,000 a month.

On the passenger side, the E190 model continues to be the most traded model of the E-Jet family. Lease rates continue to strengthen and are in the $95,000-100,000 range now, although some recent activity have seen lease agreements in the $80,000-85,000 range. The leases are dependent on the vintage and condition and lease rates can reach above $100,000 according to one source.

The E190 market continues to be a liquid market and operators continue to add capacity.

Fleet Tracker shows that Australian regional operator Alliance Air added three ex-Jetblue Airways aircraft in the first quarter. South Africa’s Airlink has sourced E190 capacity while in Europe Marathon Airlines continues to add aircraft to its fleet.

Acquisitions largely involve US fleets and in the past trading has been as low as $2.5-3.5 million on certain run-out assets. Airfinance Journal is aware of a recent aircraft on offer for $5.5 million with engines in need of investment.

NAC continues its exit strategy from the E1 market. It recently sold to Falko 20 of an initial portfolio of 50 E190s offered last September. AFJ understands that the remaining 30 units are being sold to other parties.

In December Truenoord completed a sale agreement for 11 regional aircraft with the Irish lessor, including four E190s. Last year NAC also sold three E190 airframes to Executive Jet Support.

Lease rates have been rising for the type with further increases expected in 2024, and the market anticipates the strong secondary market to continue for three to five years.

The E1 market has experienced some transition activity over the past three years with many E190s finding new homes in Europe, Africa and Australia. South African carrier Airlink is still adding E190 capacity while lessors trade used assets. In 2023, Embraer recorded 75 E-Jet transitions to new operators and 17 transitions between asset owners (lessor to lessor). The OEM expects similar activity in 2024.

Activity is less buoyant on the E195 passenger side.

“There is very little supply of E195s in the market. With numerous operators looking for lift, available aircraft in good condition would be easily placed,” comments one pollster. However, another respondent points out that the type (along with the E190) is expensive to maintain and harder to remarket.

Lease rates have improved since 2021 and are now believed to be in the $105,000-120,000 per month range.

Embraer is guiding between 72 and 80 commercial deliveries in 2024, up from 64 commercial deliveries in 2023.

CRJs

The market for the CRJ700 is vying for CRJ200 replacement in a three-class configuration but is fairly limited. Skywest Airlines, which operates through partnerships with United Airlines, Delta Air Lines, American Airlines and Alaska Airlines, has added CRJ700s over the past two years. Still the data shows that about a third of the CRJ700 fleet is not in operation.

The CRJ900 model benefits from a unique capacity for the US market and as such ranks the highest among the Bombardier-MHI models. “The CRJ900 is economically good at its job,” comments one pollster.

There are 212 CRJ900s, 210 CRJ900LRs and 41 CRJ900ERs with lessors, representing 72 aircraft. Falko is the largest leasing entity with 38 units, and in 2023 it continued to invest in the programme with acquisition of units leased to Air Canada.

The top three carriers representing the CRJ900 market include Delta with 127 aircraft, 76 with American Airlines and 47 for Mesa Airlines.

The Phoenix-based regional carrier recently entered into agreements to sell 15 CRJ900 airframes and 65 CF34-8C5 engines to various third parties to pay down debt. In a January update, Mesa said it also sold seven CRJ900 aircraft for gross proceeds of $71.2 million, and it sold seven remaining 11 CRJ900s previously contracted for sale for gross proceeds of $21 million.

Aeronautical Engineers (AEI) plans to complete studies on potentially introducing new freighter programmes this year for the CRJ900 model. It will be interesting to see if the project goes ahead.

The CRJ1000 market potential is almost inexistent. Some carriers are adding the type to their fleet to cover shortages (Lufthansa Group taking five units from Cityjet) but about a third of the fleet is inactive. Air Nostrum remains the largest operator and while some Hop aircraft may end up with French start-up Celeste, the CRJ1000 population is mainly being traded for part-out.

Last year Nordic Aviation Capital sold 18 ex-Garuda Indonesia units to Beautech Power Systems, some on behalf of Export Development Canada. In 2022, USA-based aircraft trading firm Jetcraft acquired the 14 CRJ1000 regional jets owned by Hop. Some CRJ1000s were sold to Regional One and were placed under lease agreements with Cityjet last year.

“The CRJ1000 has a very limited operator base, no trading, and values are similar to the CRJ900,” comments one pollster.

Dash 8

The De Havilland Canada Dash 8-400 model offers a cheap alternative from the turboprop segment, although production of new aircraft could happen in a few years’ time. Still the aircraft is described by a “Prima donna aircraft”, by one respondent who adds: “Treat it well and it will perform”.

Lease rates are believed to be in the $50,000-65,000 range for Dash 8-400s, although some transactions may be lower than $50,000 a month.

After the Flybe and Austrian fleets, Dash 8-400 activity over two past years has been around the Horizon Air fleet.

An operator since 2001, Horizon Air retired its final Dash 8-400 aircraft from service in January 2023. The retirement marked the end of an era for Horizon, the Alaska Airlines feeder which operated 32 aircraft of the type at the end of 2021. It began gradually parking its turboprop fleet in the second half of 2022 and entered 2023 with just nine active turboprops.

Fleet Tracker shows that South Sudanese carrier Kush Air and Kenyan start-up carrier Dragonfly Aviation acquired ex-Horizon Air Dash 8-400s in December 2023. In October US-based Jetcraft Commercial announced the acquisition of a portfolio of 12 Dash 8s from Horizon Air.

In January Canada-based aircraft leasing major modification centre and aircraft maintenance services provider Tronos Aviation acquired a pair of ex-Horizon Air Dash 8-400s, built in 2007 and 2011, according to Deal Tracker.

NAC has also sold some Dash 8-400s to parties over the past year, including Ireland-based Formidion Aviation, which acquired 16 units. Formidion also purchased three Dash 8-400s from Aercap last year.

The Dash 8-400 market remains soft in terms of lease rates. Sources say aircraft can be placed as low as $40,000 a month on long lease and multiple aircraft, depending on the credit, while the upper end of the market is in the $70,000 range.

One pollster argues that residual values continue to be soft and are lower than the smaller Dash 8-300 model.

Over the past two years, some sales have been rumoured as low as $1 million for run-out aircraft, while other distressed sales have fetched $2.5 million pricing with investment on the engines needed. "It is a difficult selling market for leases attached because of the maintenance investment needed,” says a source.

Still, the market has recently seen some transactions with Nordic Aviation Capital and Aergo Capital having cleared parts of their portfolios.

Aergo Capital sold two 2003/04-vintage ex-Flybe Dash 8-400 aircraft to aircraft parts company Airstart in January. Last November it completed the sale of four Dash 8-400s to Falko Regional Aircraft managed fund, Falko Regional Aircraft Opportunities Fund II. The 2014-vintage aircraft have leases attached to Ethiopian Airlines. It also completed a seven-unit Dash 8-400 sale assignment to Conair in 2023.

Aergo also placed two ex-Flybe units on lease to Luxwing and placed another Dash 8, previously operated by the UK operator, on lease to National Jet Express.

Canadian regional carrier PAL Airlines continues to add Dash 8-400s to its fleet for regional service in eastern Canada. The capacity provider signed a commercial agreement with Air Canada last year and operates as Air Canada Express.

ATR continues to lead Air Investor Poll

Two of the top three regional aircraft are now turboprop models in the Air Investor poll from AFJ.

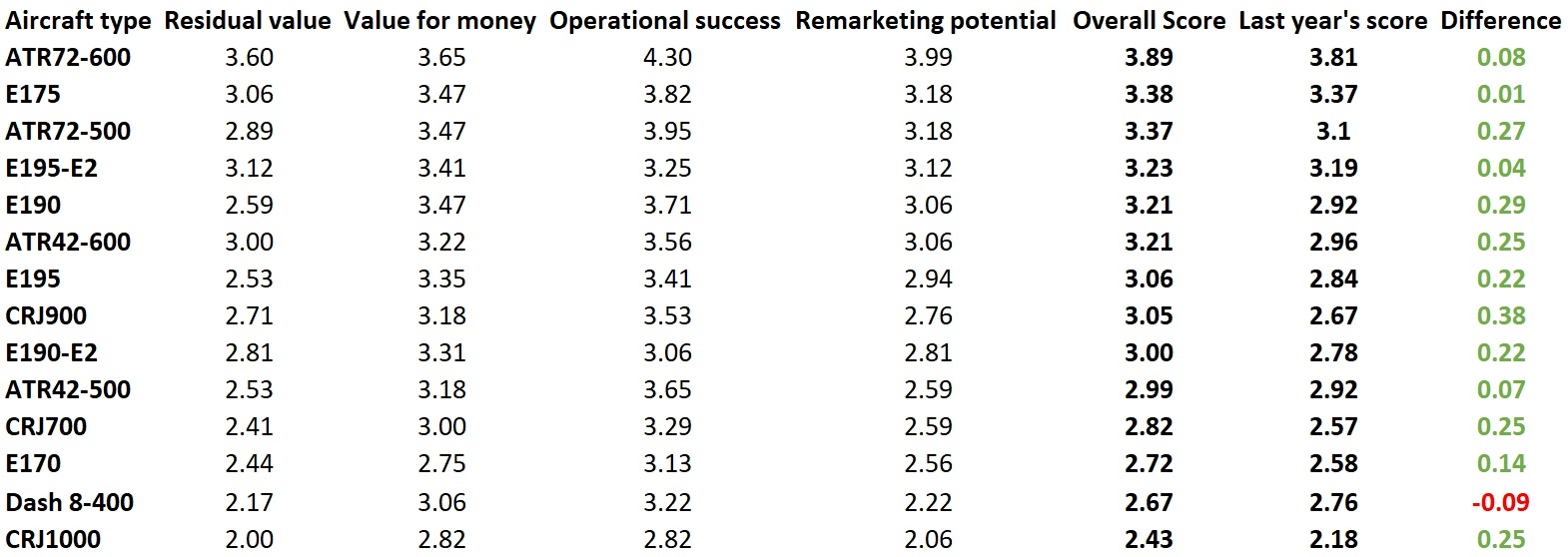

Airfinance Journal Investor Poll 2024 - Regionals

The European turboprop manufacturer delivered 36 aircraft in 2023, a 44% increase from 2022, although it missed its target of 40 deliveries. In 2022 ATR delivered 25 aircraft to customers.

ATR recorded 40 new aircraft sales during the year, a 53% rise from the prior year and revenues almost reached $1.2 billion in 2023 with $400 million from services, a record for the manufacturer.

The ATR72-500 still finds some applications, as evidenced by TAG Airlines having recently completed its four-aircraft transactions with Willis Lease Finance. The aircraft are on five-year leases.

The ATR42 products are more niche but still useful for the right markets. Their commercial mission is aimed at the 50-seat market and below. A rpime example is the sale of an 1996-vintage ATR42-500 to Scottish carrier Loganair, which has added ATRs as a Saab 340B fleet replacement.

Maldivian and Toki Air have announced orders for the type, complementing their ATR72-600 fleets. The market is relatively slow in terms of secondhand activity and about 10 aircraft are still inactive.

Like the ATR42-600, the larger ATR72-600 market remains almost unchallenged as no alternative is in the market.

AFJ reported that new aircraft sales are in the $23 million region. Lease rates for new aircraft can vary between $170,000-190,000 a month according to sources in that market.

One source says turboprop lease rates have increased 15% since around this time last year. "You’re heading towards the $100,000 mark for some used ATRs, particularly for the better credits.”

"It is a long way from where we were during Covid, but not that far off from where we were last year given the shortages in aircraft,” the source adds.

Offers in 2023 were believed to have fetched around the $170,000 a month, one pollster says.

“The best turboprop option for most applications, but second lease is not always palatable,” comments one pollster, while another notes the ATR’s “short-term remarketing strength”.

One pollster notes that there are over 300 -600s on operating leases, representing more than half the fleet. “There are a wide range of lessors which see some competition but not as much as in the mainline jet market. Lease rentals of the -600F are high and the future for the turboprop is good.”

Still ATR would work to clear out inactive aircraft that may be stored or simply in transition between customers. Fleet Tracker shows that around 90 ATR72-600s are currently inactive out of a 614-aircraft fleet.

In comparison, around 165 Dash 8-400s are still in storage or transition out of a 550-aircraft fleet. “A lot of surplus used aircraft are currently in the market. The turboprop market needs something that offers more than 100% SAF capability,” comments one pollster.