Market competitors: Airbus challenges Boeing dominance of mid-size freighter category

During the Covid pandemic the freighter market provided a rare positive story, as air cargo carriers and freight forwarders enjoyed increased demand, whilst other aviation sectors were badly hit and available freight capacity on passenger aircraft was drastically reduced.

Although the passenger market is recovering and belly freight capacity is returning, there are signs that cargo-only operations continue to benefit from increased demand, not least as a result of growing e-commerce activity. In the light of this activity, aircraft manufacturers and conversion facilities are targeting the freighter market and Airbus is aiming to loosen Boeing’s grip, particularly in the mid-size category.

Manufacturer offerings

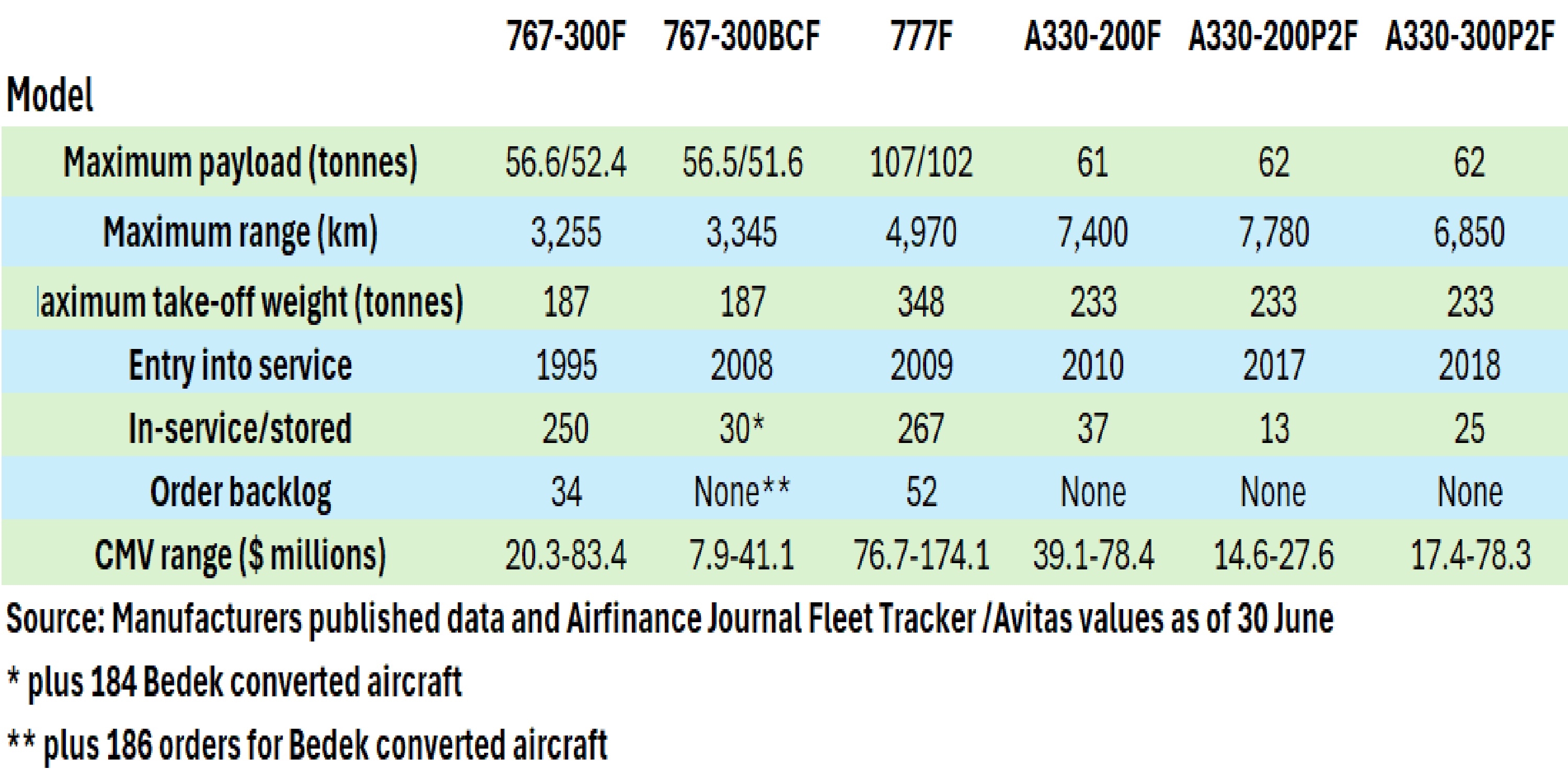

Boeing has a long-established and successful range of widebody freighters. Current production models include the 777F and the 767-300F. In addition to the factory-built models, the US manufacturer offers the 767-300BCF - its own passenger to freighter conversion. Third-party 767 conversions are also available, notably from IAI/Bedek. A freight version of the 777X programme, based on the -8 variant is planned, but entry into service will not be before 2027.

Airbus has traditionally lagged Boeing in the freighter sector, but has been trying to increase its presence with new models. In the widebody sector the European manufacturer offers the factory-built A330-200F and the A330P2F conversions.

Airbus is also introducing the A350F - a large freighter that will compete with the 777-8F model. The European manufacturer is targeting 2026 for entry into service - so the aircraft looks likely to be in operation before its Boeing rival.

With the latest models from each manufacturer yet to enter service, the current choice for operators is between the Airbus A330 models and the 767/777 variants from Boeing. Given that the 777F has nearly twice the payload of the other Boeing and Airbus models on offer, the direct competition boils down to the A330 models versus the 767 factory-built and converted versions.

Although the A330P2F and 767-300BCF models are marketed as OEM conversions, both Boeing and Airbus use third parties to carry out the actual conversion work. Airbus programmes are managed by Elbe Flugzeugwerke (EFW) - a joint venture between the manufacturer and ST Aerospace. The Singapore-based company is also a one of the Boeing designated facilities for the 767-300BCF model.

Airbus says the large number of passenger A330s in service provides a source of aircraft to support the freighter conversion for many years. Both the A330-200 and A330-300 versions are eligible for the P2F conversion. According to the manufacturer, the longer-fuselage A330-300P2F is particularly suited for integrators and express carriers because of its high volumetric payload capability with lower-density cargo. The marketing material says the A330-200P2F is optimised for higher-density freight and longer-range performance.

Leading characteristics of main in-production widebody freighters

A niche market

Despite its increased profile during and post the Covid crisis, the freighter market remains small compared to its passenger counterpart. In the medium-sized category (excluding 777 and 747 models) the manufacturers have delivered fewer than 400 of the types they currently offer.

However, this somewhat understates the market size as the freighter fleet includes older models such as the 767-200F and the narrowbody 757-200F. The two older Boeing models have a combined in-service fleet of around 300 aircraft according to Airfinance Journal’s Fleet Tracker.

Nonetheless, the market appears limited given it is now being targeted by both of the main airframe manufacturers. The backlog of orders does not look encouraging for any of the competitors. Freighter orders are typically made relatively close to deliveries, which tends to keep backlogs low, but the absence of any outstanding orders for the two available Airbus models is striking. The low numbers for the Boeing models is mitigated by the relatively healthy backlog for the IAI/Bedek conversion.

Market size

Airbus says that of the approximately 2,700 freighters required during the next 20 years, about half of the total demand will be required in the mid-sized segment in which its A330 sits. The figure includes an estimated 900 conversions. In its marketing literature Airbus suggests: “As the mid-sized freighter segment has always been the largest in terms of demand, the replacement cycle is continuous.”

Conversion candidates

The volatile supply of suitable aircraft for conversion (feedstock as the industry calls them) adds to the difficulties faced by conversion facility management and planners. In the case of the 767 and A330, industry sources suggest there are currently around 200 passenger models of each type that are in the right age range to make them conversion candidates. The number of 767 candidates will dwindle over the next decade, whereas the number of A330s of suitable age (typically 18-35 years) should be more stable.

Operating costs

Many operators see the later generation A330 as a good replacement for the 767 as it offers around 20% greater cubic capacity as well as a significant payload advantage over the 767. The A330 is, however, more expensive to acquire and operate. It has a longer range capability, but this is not always required by operators - particularly in the express package market.

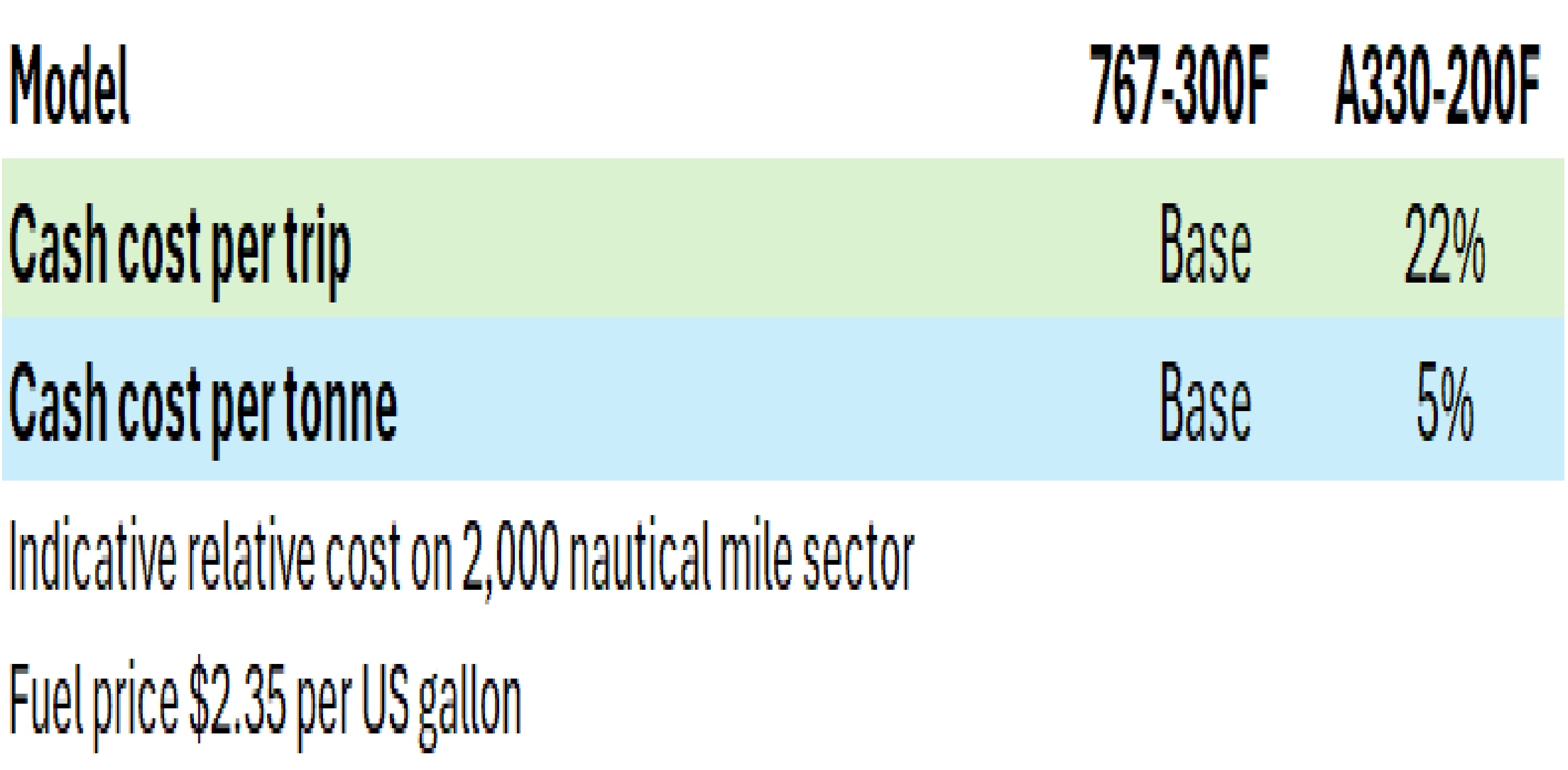

Assumptions: Aircraft characteristics, fuel burns and block times are based on Airfinance Journal’s interpretation of manufacturer claims and published data

Analysis by Airfinance Journal on the two factory-built models confirms the significantly higher costs of operating an A330-200F compared with the 767-300F.

On a 2,000 nautical miles sector in a high fuel price environment ($2.35 per US gallon) analysis by Airfinance Journal indicates that the cash operating costs of the A330-200F is around 22% higher than the 767-300F. The cost per tonne for the A330 model remains higher than that of the 767 by about 5%. This might seem surprising given the newer technology of the A330 model, but it is explained by the significantly greater take-off weight and range of the Airbus model. Whether this greater capability is required by potential operators is another question.

According to further Airfinance Journal analysis the cash operating cost of the converted freighters are broadly similar to their equivalent factory-built variants.

There may be advantages in terms of maintenance for new-build factory models, but this is more to do with warranties and support packages than intrinsic costs. Capital costs are difficult to compare as manufacturer pricing for new models is opaque and the cost for converted models is dependant on aircraft age. Avitas values incorporated in Airfinance Journal’s Fleet Tracker indicate that the current market values for new-build factory freighters are typically double the values of the most recent converted models. The converted models therefore have clear advantages for the typically low utilisation of freight aircraft operations.