Legal Survey 2025: Clifford Chance remains top law firm

Airfinance Global has received submissions from 22 law firms, compiling 1,422 unique deals, including transactions gathered from our deal database, Market Intelligence.

This was down from the previous year with 1,534 unique deals from 18 law firms.

The number of transactions recorded in 2023 was 1,196 unique deals, a similar level of transactions as in the previous year.

Market share

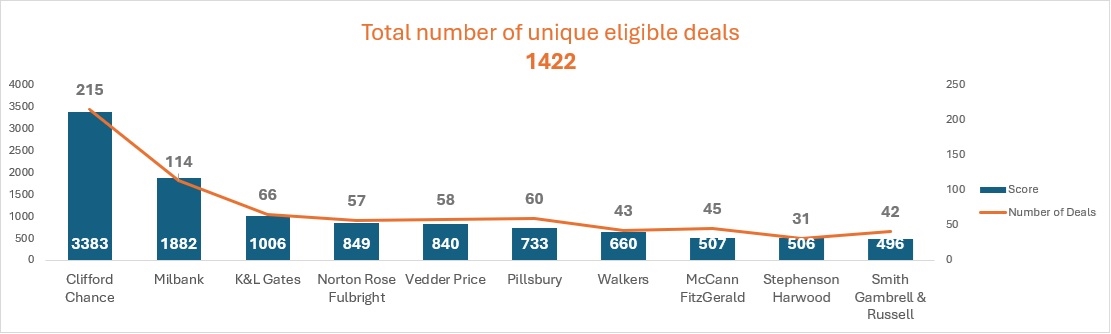

Clifford Chance, Milbank and K&L Gates remain the top three law firms in commercial aircraft but other law firms continue to catch up.

K&L Gates recorded 66 eligible transactions last year versus 65 the previous year.

Pillsbury, Vedder Price and Norton Rose Fulbright completed the top six with 60, 58 and 57 transactions, respectively.

Clifford Chance and Milbank recorded a similar level of transactions last year as in 2023. However their scoring improved by 250 points and 130 points respectively while K&L Gates, and Pillsbury saw their scores at similar levels. Vedder Price and Norton Rose Fulbright improved their scores versus the prior year, the data shows.

In the legal survey 2025, the three law firms represented 28% of the transactions, up from 25% in the legal survey 2024 and 26.5% in the prior year.

Nevertheless, Clifford Chance remains number one among the law firms amongst the regions as well as in the commercial loans, operating lease, sale and purchase, and structured lease categories.

Clifford Chance represented 15.1% of the total transactions recorded by the survey, with 215 eligible deals. This compared with 209 eligible deals in the 2023 survey, accounting for 13.5% of total transactions.

"Our recognition as the leading firm in the Airfinance Global Legal Survey reflects a long history of deep and unwavering commitment to the aviation sector. This prestigious accolade underscores our focus on excellence for our clients, and an unparalleled expertise in the sector. As a truly global team, Clifford Chance is uniquely positioned to navigate the nuanced complexities that shape the aviation sector around the world. By assembling the brightest minds in the industry, we're able to consistently deliver exceptional results for our clients in a competitive global market. This recognition acknowledges the dedication and hard work of our global team and reflects the results that come with bringing the highest level of service and innovation to our clients," said Zarrar Sehgal, global head of Clifford Chance's asset finance group and co-head of the firm's industrials, transport & mobility sector group.

Milbank recorded 114 eligible deals last year, compared with 112 the prior year. This represented 8% of all eligible transactions.

Airfinance Global would like to thank all the law firms that participated in the survey.

Methodology

Airfinance Global’s annual legal survey includes aviation finance deals based on submissions from law firms and our own Market Intelligence database. The data is subsequently aggregated to create the winners.

The Airfinance Global data team then reviews the different deals and selects those eligible for Deal Tracker. This list is then used to select the most active law firms, which are then selected by region and product type.

The legal survey reviews transactions for the calendar year 2024 only. This is significant because we recognise that markets change, as do law firms; however, this was the only way to offer an accurate snapshot of aviation finance legal activity.

Our aim is to continue being transparent and impartial. All of the deals are eventually loaded into Market Intelligence database and can be reviewed by our readers. In this sense, our survey is unique. Our research team assesses each deal to verify them and to avoid double counting.

The benefit of using Market Intelligence is that we can offer a granular presentation of law firm activity by product type and region.

However, the survey has limitations. Client confidentiality may be an issue for law firms when submitting deals, and some firms opted not to participate. As a consequence, the survey does not necessarily represent all of the deals happening in the marketplace, but it remains the most comprehensive survey of its type and offers real insight into the aviation market.

Law firms were asked to self-assess the complexity of each transaction and their role in the transaction according to the following new set of criteria for which the specified points will be awarded:

Complexity:

• Ground-breaking pioneer transaction: 10 points;

• Complex transaction, some new parties or jurisdictions: 7 points;

• Average complexity, repeat transaction with same players and jurisdictions: 5 points;

• Less complex transaction: 3 points; and

• Low complexity: 1 point.

Role:

• Drafting counsel for major transaction documents: 10 points;

• Primary counsel to major transaction parties: 7 points; and

• Secondary counsel to transaction parties: 3 points.

For all Market Intelligence transactions that were not part of the submitted deals, Airfinance Global assigned one point for the complexity of a transaction and three points for the role played by the law firm. This resulted in a total score of four for all Deal Tracker transactions that were not part of the submitted deals.

Like previous years, the survey records the overall number of deals for each law firm. As defined by the survey, a deal represents one mandate and can include multiple aircraft and lawyers.

In addition to presenting the most active law firms by product and region, the survey aggregates their performance to produce an overall ranking. Law firms secure points based on their placement in each region, product, and category.

Airfinance Global will disclose law firms' split per regions and categories in subsequent articles.